Why Be a Listener When You Can Be an Investor?

Why Be a Listener When You Can Be an Investor?

In a world buzzing with countless voices and opinions, the art of listening often takes a back seat. Yet, as we navigate through a cacophony of sounds-be it in personal relationships or the broader marketplace-the question arises: why settle for passive observation when active investment holds the promise of transformation? This article delves into the significance of shifting our mindset from mere spectators to proactive investors, both emotionally and financially. By exploring the benefits of engagement over distance, we’ll uncover the profound impact of investing in ideas, relationships, and oneself. Join us as we chart a pathway from passive listening to dynamic participation, highlighting the opportunities that await those who dare to take a step beyond the sidelines.

Exploring the Value of Active Listening in Investing Dynamics

In the intricate tapestry of investing, active listening serves as a powerful tool that transcends mere transaction. It allows investors to glean insights beyond numbers and charts, fostering a deeper understanding of market sentiment and emerging trends. By engaging in genuine conversations with peers and industry experts, investors can:

- Identify Unspoken Trends: Often, the most potent investment opportunities lie between the lines of conversation.

- Build Trust: Establishing rapport can lead to valuable partnerships and collaborations.

- Enhance Decision-Making: The subtleties picked up through active listening can illuminate paths not yet considered.

Additionally, embracing an active listening approach nurtures a culture of continuous learning. In a world where information overload is the norm, the ability to filter what truly matters becomes invaluable. Effective communicators not only absorb what is said but also interpret emotions and intentions behind the dialogue, allowing for nuanced perspectives. Consider the following table showcasing the contrasts between passive and active listening in investing:

| Passive Listening | Active Listening |

|---|---|

| Focus on personal gain | Concentrate on shared insights |

| Absorb information superficially | Engage deeply with the content |

| Limitations in understanding | Broader market awareness |

Unlocking Opportunities: How Engaging with Ideas Enhances Your Investment Strategy

In today’s rapidly evolving financial landscape, simply absorbing information is no longer sufficient. To truly thrive, investors must actively engage with diverse ideas and perspectives. This engagement can illuminate investment opportunities that might otherwise go unnoticed. By participating in discussions, attending seminars, and exploring forums, you can gather invaluable insights that enhance your decision-making. Consider the following approaches to deepen your knowledge:

- Network with Visionaries: Connect with thought leaders who challenge conventional wisdom.

- Participate in Investment Clubs: Collaborate with others to share ideas and strategies.

- Attend Workshops: Access specialized knowledge tailored to emerging trends.

- Read Diverse Publications: Gain varied perspectives that can inform your investment philosophy.

Engaging with ideas not only fosters growth but also cultivates a proactive mindset. This mindset can transform an investor’s approach to market volatility and shifting economic conditions. Think of your investment strategy as a dynamic ecosystem, one that thrives on adaptation and continuous learning. Below is a simple table illustrating key benefits associated with proactive engagement:

| Benefit | Description |

|---|---|

| Diverse Perspectives | Broaden your understanding through varied viewpoints. |

| Real-Time Insights | Access timely information that impacts market movements. |

| Increased Confidence | Make informed decisions supported by a wealth of knowledge. |

Q&A

Q&A: Why Be a Listener When You Can Be an Investor?

Q1: What does it mean to be a listener in the context of investing?

A1: Being a listener means taking the time to understand the market, trends, and the needs of businesses. It involves absorbing information, gauging public sentiment, and recognizing emerging opportunities before making investment decisions.

Q2: Why do some people choose to be listeners rather than investors?

A2: Some individuals prefer to listen because it allows them to learn and adapt without committing financial resources. They may feel cautious, valuing knowledge and understanding as essential before making any investment. It can also be a way to experience the market without the risks associated with investing.

Q3: What are the advantages of being an investor?

A3: Investors can potentially reap financial rewards by capitalizing on their insights and trends. Investing enables individuals to support innovative ideas and entrepreneurs, driving economic growth. Plus, investments can provide passive income and build wealth over time.

Q4: Can listening complement investing?

A4: Absolutely! Effective investors are often great listeners. By understanding market nuances and gathering insights from various sources, they can make informed decisions, minimizing risks and maximizing potential returns. It’s about combining knowledge with action.

Q5: What are some strategies for transitioning from a listener to an investor?

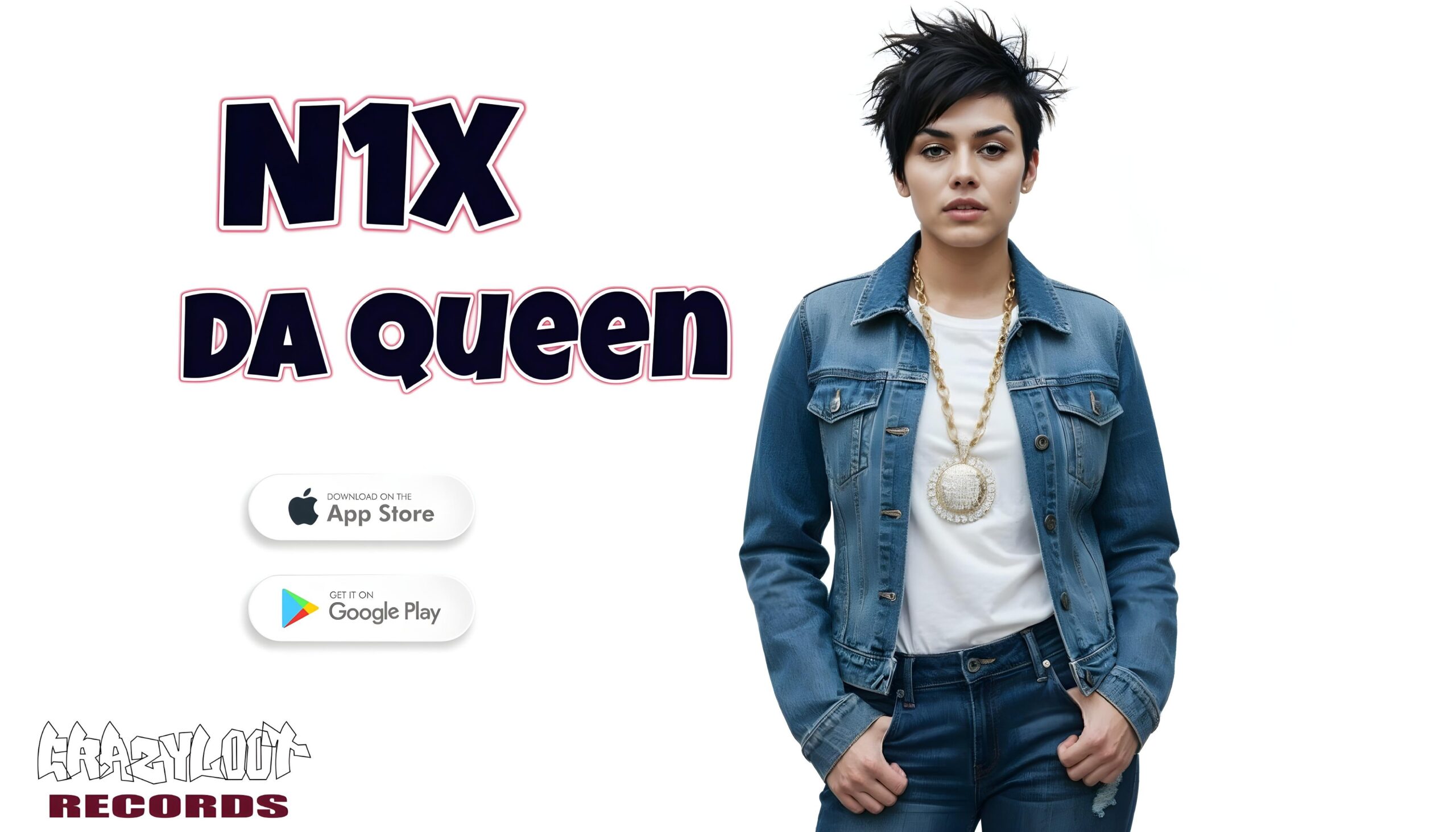

Meet N1X Da Queen Of A-Pop

N1X Da Queen Of A-Pop Sign up And Enter Her World Streaming Exclusive Music From N1X And Da Super Group Da Queens

Only On N1XMusic.com

A5: Start by engaging in educational forums, webinars, or investment clubs to enhance your understanding. Set small investment goals and gradually increase your stake as you gain confidence. Additionally, consider using simulation platforms to practice without financial risk.

Q6: What are the risks of being solely a listener?

A6: Staying solely in the listener mode can lead to missed opportunities. Markets are constantly evolving, and hesitation can result in a lack of engagement with potentially lucrative investments. There’s also a risk of becoming overwhelmed with information, leading to indecision.

Q7: Are there any famous investors who emphasize the importance of listening?

A7: Yes, renowned investors like Warren Buffett often speak about the value of listening to diverse viewpoints and learning continuously. They advocate for understanding businesses deeply, which is only possible through active listening and observation.

Q8: In your view, what is the ideal balance between being a listener and an investor?

A8: The ideal balance lies in being an active listener while also taking calculated risks through investing. Continuous learning should inform investment decisions, ensuring that actions are grounded in knowledge, but prompt execution is key in a fast-paced economic landscape.

Q9: How can someone enhance their listening skills in investing?

A9: Engage with various media sources, follow market analyses, attend investment talks, and discuss with peers. Active listening entails asking questions, reflecting on insights, and synthesizing information into actionable strategies.

Q10: What final thoughts would you offer to those at the crossroads of investing and listening?

A10: Embrace both roles! Cultivating an inquisitive mind while being willing to act can elevate your investing journey. Remember, investment is not only about money; it’s about believing in visions, understanding trends, and becoming a part of something larger.

Final Thoughts

As we wrap up our exploration of the age-old debate, “Why Be a Listener When You Can Be an Investor?”, it becomes clear that the choice isn’t merely about the roles we play, but rather the impact we make. Listening allows us to gather insights, understand diverse perspectives, and foster connections that can ultimately shape smarter investments. Conversely, being an investor empowers us to act on those insights, transforming ideas into tangible results.

In the end, the most successful individuals often blend these roles seamlessly. They listen deeply to the world around them while boldly investing in their visions and the potential of others. Embracing both skills can create a harmonious balance, igniting innovation and driving growth-whether in personal endeavors or the larger community.

So, as you ponder your next steps, consider how you can move beyond the choices of listener or investor, and instead, embody the essence of both. After all, in a world that thrives on collaboration and shared ambition, the true power lies not just in what we choose to do, but in how we choose to engage.

Are you a content creator or someone with a big social media following?

Want to earn real cash promoting The Queen of A-POP?

Join the N1X Music Promoter Program — it’s as easy as:

1️⃣ Sign Up

2️⃣ Promote

3️⃣ Get Paid

No Comments